Payment options

Buy now, pay later. We have finance options, including rental, to suit every budget.

Buy today & pay over time.

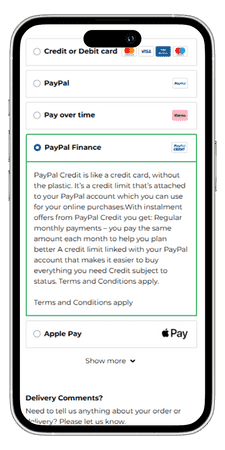

Enjoy 0% interest for 4 months on all purchases over £99 when you choose PayPal Credit. Terms and conditions apply. Subject to status.

PayPal Credit works like a credit card without the plastic. It’s a credit limit linked to your PayPal account that you can use for your online purchases.

0% interest every time.*

There’s no need to wait for a special promotion or limited-time offer. With PayPal Credit, any purchase of £99 or more automatically qualifies for 0% interest for 4 months.

It helps you spread the cost of those bigger purchases you need now, without paying anything extra.

*Subject to status

0% interest for 4 months on purchases £99 and over

Spread the cost of your purchases without paying interest if you pay off your balance within the promotional period.

Spread the cost with instalment plans

Make larger purchases more manageable by breaking them into affordable monthly payments.

Built into your PayPal Wallet

Pay easily at millions of retailers using your existing PayPal account.

Quick application

Complete a short form in just a few minutes to see if you’re approved.

Easy management

Manage your PayPal Credit account anywhere, on desktop, mobile, or tablet.

Instant access

Get an immediate yes or no, and if approved, start shopping straight away.

In safe hands

Your details are never shared, and eligible purchases are covered by PayPal Buyer Protection.

FAQs

Existing PayPal credit customers

What if I don't have a PayPal account?

What happens if my item is returned?

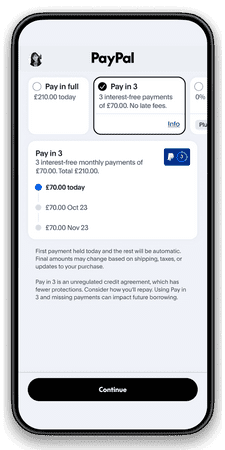

Pay in 3 interest-free payments

Need a little flexibility at checkout? PayPal Pay in 3 lets you divide your purchase into three equal payments, with the first paid today and the rest automatically collected each month. There’s no interest, no setup fees, and no surprises. Just a simple way to spread the cost when it suits you.

Example of a £75 purchase

No interest or set-up fees

You’ll never pay more than the purchase price. PayPal Pay in 3 is completely interest-free, with no sign-up or hidden fees, as long as you make your payments on time.

Get a decision in seconds

When you choose Pay in 3 at checkout, you’ll get a quick decision with no long forms. Most customers find out instantly whether they’re approved.

Available for eligible baskets between £20 and £3,000*

Whether you’re making a small purchase or something more significant, Pay in 3 can be used on a wide range of orders.

*Subject to status

Fully integrated with your PayPal account

Everything is managed from the PayPal Wallet you already use. You can track payments, see due dates and manage your plan with ease, all in one place.

FAQs

What is PayPal Pay in 3?

Can PayPal Pay in 3 ever impact my credit score?

How long will my PayPal Pay in 3 plan last?